Broadcom: Inventory Doesn't Lie

Broadcom (AVGO) reports record-low inventory levels and 46% AI revenue growth. Analyst insights on valuation risks and future catalysts.

"Frontier Stocks" Publication: 20% Discount Offer Link.

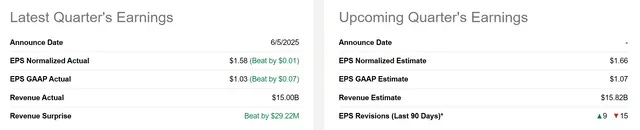

Broadcom Inc. (NASDAQ: AVGO) recently announced its second-quarter earnings preview. As shown in the chart below, the company's reported performance exceeded market expectations in both aspects. This article will focus on two aspects that have been less discussed so far: the scalability of its AI capabilities and inventory levels.

Digging deeper into Broadcom's strong second-quarter performance, analysts found that AI-related products (including its semiconductor solutions and infrastructure software sectors) were key drivers, as shown in the chart below with revenue breakdown by division.

In summary, in the second quarter, Broadcom's AI revenue grew 46% year-over-year to $4.4 billion, while infrastructure software revenue grew 25% year-over-year to $6.6 billion.

Looking beyond the second quarter, its scalable AI products will have broad room for development.

In the earnings report, management reiterated that Broadcom maintains good relationships with three major hyperscale customers and is actively collaborating with other clients.